The biggest stock market scam has already taken place or the matter is yet to discover? Under the co-location scam member of Lok Sabha, Arvind Sawant stated the amount of 75000 crores and a journalist who filed public interest litigation to SEBI-Technical Advisory gave the amount of 50,000 crores. The Securities and Exchange Board of India has also charged the penalties to National Stock Exchange under the Co-location scam with the interest of 12% p.a. CBI is interrogated and found former CEO and MD, Chitra Ramakrishna guilty for sharing financial projections and private information of NSE with an unknown Himalayan guru and not taking suitable actions regarding prevention of the scam.

What is Co-Location?

Co-location facilities were provided because of the gap between the actual cost price of a stock and the price coming on the screen. As we all are well aware of the fact that the price of stock changes every second and that gives a loss to hedge shareholders with a margin of crores. . To redeem this situation, NSE launched co-locality facilities for the traders who can give extra charges. Basically, through co-location facilities, the server of premium traders will be placed nearby the servers of the NSE trading system. In this way, the hike and fall in the price of the stock will reach directly and quickly to the screens of premium traders and later to the commoners.

How the scam did take place?

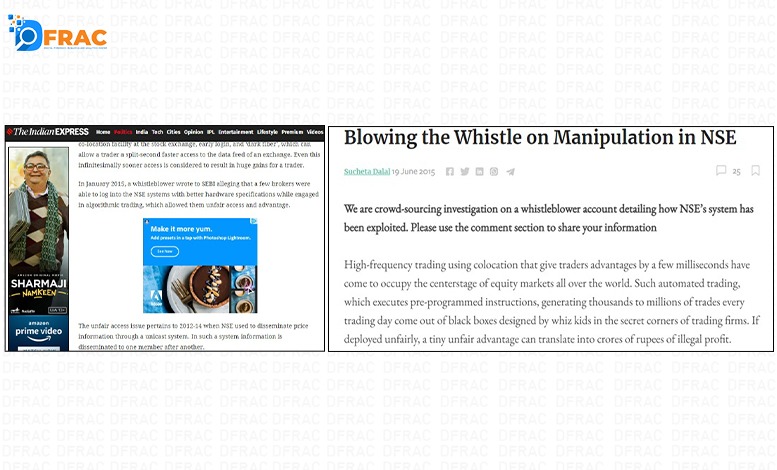

- A whistleblower, Singapore based mailed to the official of SEBI in January 2015 about how a Delhi based trader was found ahead of others and remained on the top at the site of NSE. Furthermore, he also claimed the trader was also able to access the least crowded server. Sanjay Gupta, owner of Delhi-based stock broker OPG securities was alleged to the charged by the CBI.

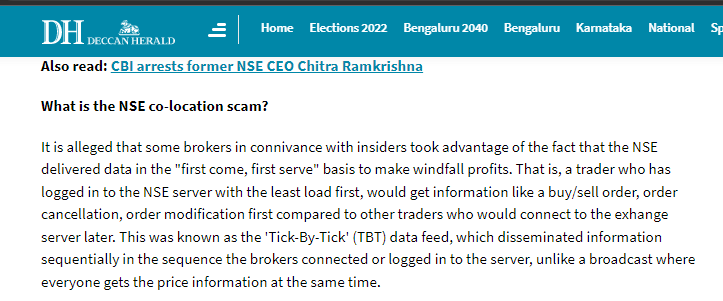

- Another thing that led to the scam was Tick by Tick system. Surprisingly users who log in first on the server of NSE would remain in front for the rest of the day and get the first shot at the trade. In this way, Sanjay Gupta with the help of NSE officials was able to crack down the least crowded servers and gain a margin profit.

- Interestingly, earlier no load balancer (a software that allocates the least crowded servers to the user) was installed in NSE which means humans were accessing the server and had commands over the servers. Although NSE introduced Load balancers in 2012 still people were able to attempt the scam by using the server kept for co-location users.

- As users started logging in to the backup server. If NSE servers are down, in that case, NSE has made a backup room called a backup server. Traders who have taken co-location facilities can use it for avoiding crowded servers. Although no users were allowed to log in to the backup server yet some brokers started logging in to the backup server regularly which led to the scam.

How do the co-location facilities affect traders?

- From the year 2010 to 2015, if traders are investing and transacting through NSE, they have paid quite a high price while buying shares and received a quite lesser price while selling because of the gap in milliseconds on their trading screen.

- NSE officials were alleged for leaking out the information about which server opens first and is less crowded to some brokers. Through which only a certain number of traders used to get the first attempt and know about the original digits.

- National Security Scam has defamed India’s biggest stock exchange institution on international grounds. Millions of people invest in NSE, every trader has been a part of a scam for 5 long years.

- After the Harshad Mehta scam in 1992, the National Stock Exchange came into existence to improve transparency in the Indian equity market. Although the co-location scam and mistakes of Rama Krishna might lead to the biggest scam in the stock exchange.

Loopholes in the scam

- The whole matter came up after the facilities of co-location came into existence. During the tenure of Chitra Ramakrishna, OPG security was able to attempt the scam by bribing officials of NSE and SEBI as per the CBI. Since 2012 NSE has been giving warnings to OPG Security still after doing the scam for at least 3 years, Sanjay Gupta, CEO of the company got arrested in 2018.

- NSE recognized the misuse of the backup server, yet they didn’t take any actions regarding it.

- SEBI charged a fine of 3 crores on Chitra Ramakrishna for sharing personal details of the price of stocks and dividends to the Himalayan Yogi, which was rumoured to be Anand Subramanian, the ex-operative officer of NSE.

Conclusion: Through our report, you will find how a stock scam was led for 5 long years, yet no such preventions have come around in the present day. Since the prevention of the scam is not in the hand of the public, the Security Exchange Board of India should take preventive steps as another whistleblower has filed another case regarding corruption taking place in NSE in the year 2022.