In the last one year as the mode of shopping has increasingly shifted online and the methods of payment too, the number of scams have also increased exponentially.

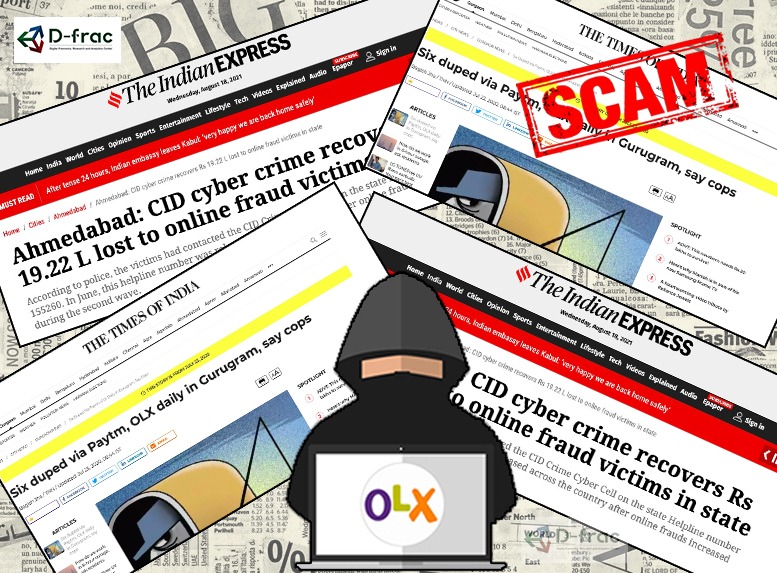

In Gurugram, at least 50 to 60 cases of fraud through Paytm and Olx are registered every month. These scams take place because there is still a gap between technical know-how of online payment platforms.

In November, Delhi Police busted a team of scammers in Vivek Vihar after the victim registered a complaint that they lost over Rs 70,000 thinking they were buying a car. These kind of scams have become extremely common in big cities.

A couple of months ago, Gujarat’s cyber crime cell prevented 27 online scams from taking place and recovered Rs 19 Lakhs from alleged scams on Olx and Quikr.

As per information released by the CID Crime and Railways department, from July 2 to July 17, the vigilance team of Cyber Crime Cell managed to contact nodal agencies of banks and e-wallets to freeze the bank accounts of alleged scammers and return the money to the victims from various locations in Gujarat.

Various authorities on state and central government level have issued advisories regarding these online scams that have warned people about the exact methods used by scammers to collect money. But despite these efforts, the scams continue to find new victims every day.

One reason why this is happening is because in India, the payment apps are not responsible for any scams that might take place on their platform. There is not insurance provided on the transactions made on the platforms. All applications such as Gpay, PayTM and PhonePe virtually do not need to get involved in scam reports. However, due to immense backlash from public, Paytm has stepped forward and is going to make their technology less susceptible to fraudulent behavior. Olx too has a page entirely dedicated to scammers and frauds informing its users to stay vigilant.

These measures are steps in the right direction but are inadequate in tackling such a massive problem. The country needs to come to terms with the fact that online payment gateways are relatively new to the masses and they must be rigorously educated on it.