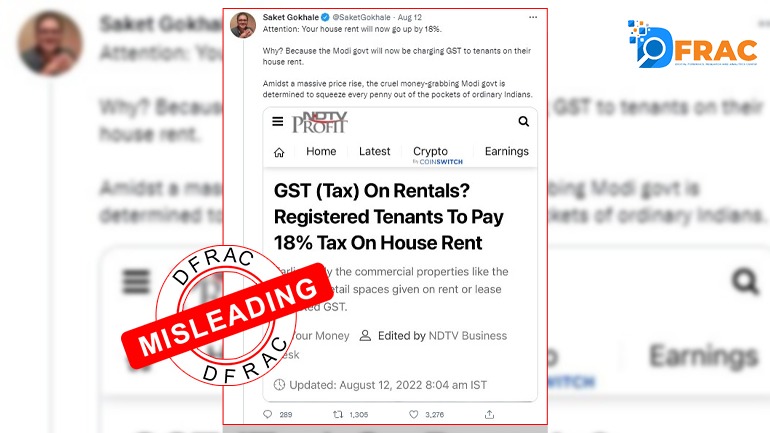

A claim is becoming very viral on social media. In which it is said that now 18 percent GST will have to be paid on house rent in India.

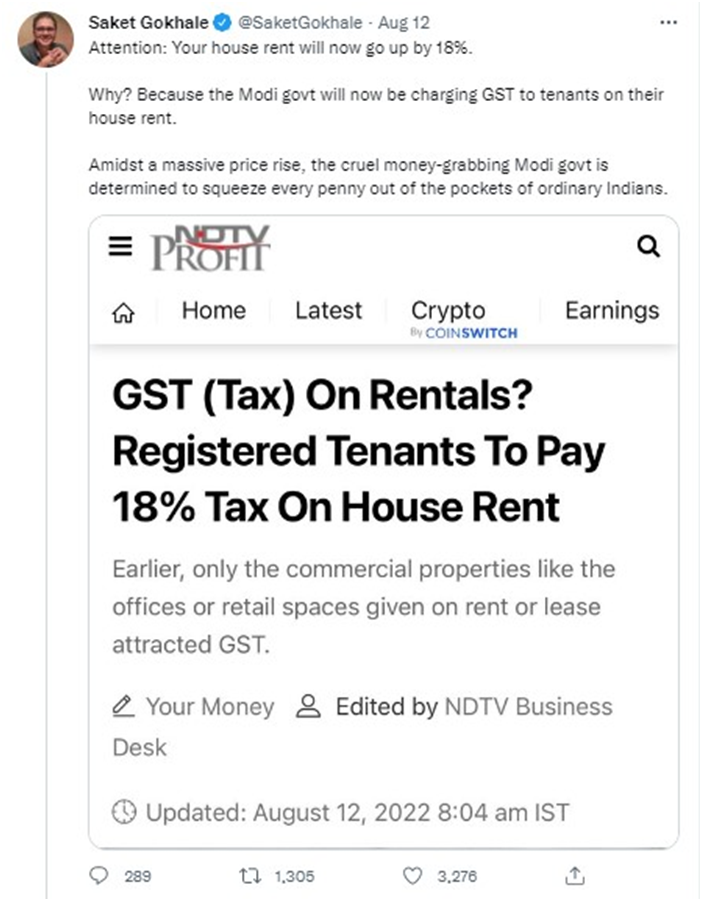

Trinamool Congress leader Saket Gokhale tweeted saying, Note: Your house rent will now increase by 18%. Why? Because the Modi government will now collect GST from the tenants on the rent of their house. Amidst the huge price hike, the ruthless money-grabbing Modi government is determined to squeeze every penny out of the pockets of ordinary Indians.

Source: Twitter

In his next tweet, he wrote, “Registered tenant” clause is a clever magic word. This means every freelancer, artist, writer, doctor, lawyer, and others who are not employed full time and have no office. If your main office is also your home, then you are covered under it.

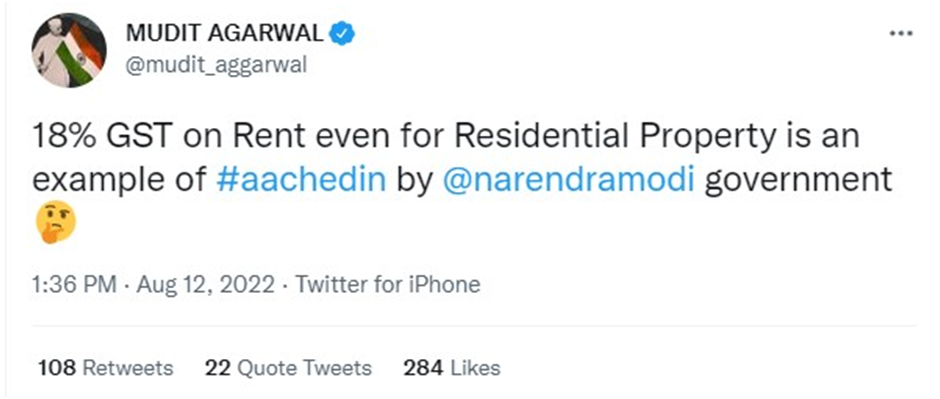

On the other hand, another user tweeted that 18% GST on rent for residential property is also an example of Modi Sarkar’s ache din.

Fact Check:

During the investigation of the above claim, DFRAC got a fact check of PIB. Refuting the claim, it was stated that the rent of a residential unit is taxable only when it is let out as a commercial unit. Also when it is rented out to a private person for personal use. So no GST is levied. Even if the owner or partner of the firm gives accommodation on rent for personal use.

Conclusion:

Hence the claim of 18% GST on house rent is misleading.

Claim Review: Now you have to pay 18% GST on rent.

Claimed by: Saket Gokhale

Fact Check: misleading