Claim

The 2025 Union Budget was announced on February 1, 2025. Many concessions were announced like the introduction of new income tax slabs, focusing on infrastructure, digital economy, healthcare, education, green technologies, social security, and schemes to support the farmers was there in this year’s union budget.

In this background, a claim is going viral on social media which states that tax rates throughout the country is really high, while the services provided by the government only nominal. The user has cited many tax rates as proof.

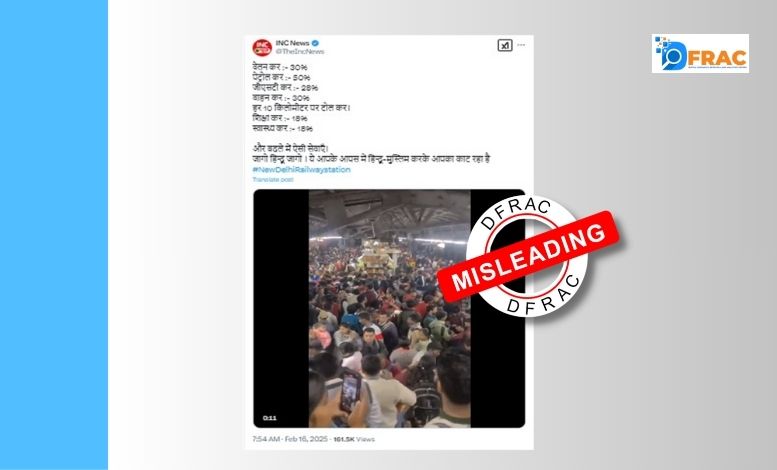

A verified user on X, INC News, shared a video of a train bogie filled with poeple and wrote, Income tax: 30%, Petrol tax: 50%, GST tax: 28%, Vehicle tax: 30%, Toll tax every 10 kilometers, Education tax: 18%, Health tax: 18%, and in return, such services. Wake up Hindus, Wake Up. They are decieving you by keeping you busy in Hindu-Muslim Divide. #NewDelhiRailwayStation”

Fact Check

To investigate the viral claim, DFRAC first glanced over the income tax in India. During this, we got to know that the tax system in India is based on a slab system. Finanace Minister Nirmala Sitharaman introduced significant changes in the income tax slabs under the new tax system in the Union Budget 2025. These new tax slabs will be effective from April 1, 2025, for the financial year 2025-26.

After this, we investigated the claims related to Petrol Tax. While inquiring into it, we found that in India, petrol is subjected to Central Excise Duty and State VAT (Value Added Tax). The VAT rates varies across various states.

Then, we inquired the claims related to GST. DFRAC got to know that India has various GST rates: 0%, 5%, 12%, 18%, and 28%. The 28% rate on GST is applicable only on luxury goods and some specialised services, which can be seen here.

After this, we investigated the vehicle tax, which revealed the fact that each state government proposes and levies its own tax, that why’s it varies in each state. The vehicle tax rate is different in different states.

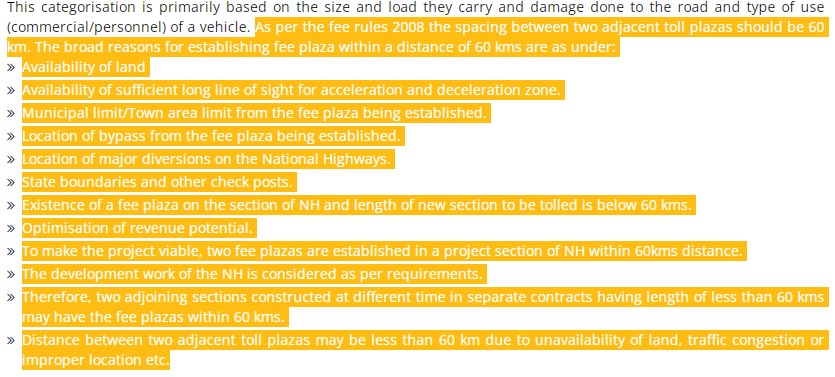

Moving forwards, we investigated the claims of a toll tax on every 10 kilometers. The investigation revealed that toll plazas can be set up after approximately 60 kilometer, this is according to the NHAI (National Highways Authority of India) rules.

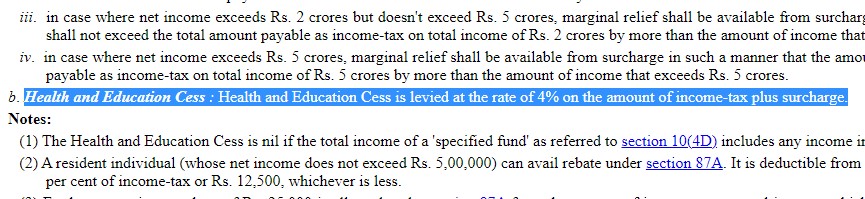

Additionally, we gathered information regarding the education and health tax. In reality the cess on these two things are really low than what was claimed by the social media user. India has a mere 4% education and health tax.

Conclusion

Therefore, it is clear by DFRAC’s fact check that the claims made by the user are misleading, as it forms an incomplete picture of the taxation in the country and has made an opinion on the basis of incorrect or incomplete information.