A message is going viral on social media claiming that ‘only Hindu Temples have to pay taxes while other religions enjoy freedom.

A Twitter user by the name of Himanshu Malhotra who is an Advocate and a businessman according to his twitter bio shared the massage and writes, “In Bihar:Temples will have to be registered, will have to pay 4% tax, Bihar State Religious Trust Board’s decision:Why only temples have to pay tax?Why not Madarasas and Churches?#FreeHinduTemple.”

Source: Twitter

Fact Check:

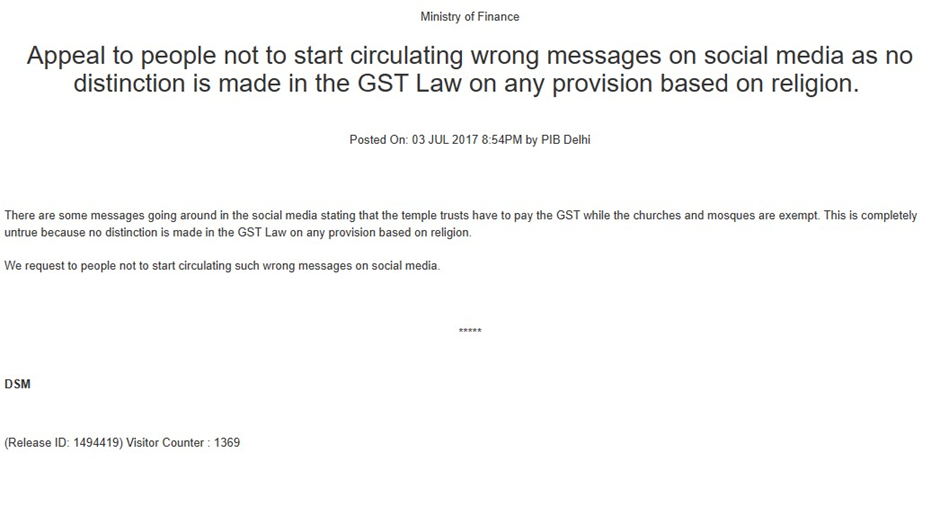

To investigate this viral claim DFRAC team used certain keywords and found a press release from the Ministry of Finance that appeals to people not to spread fake news, the levying of taxes is not at all related to religion.

Source: Ministry of Finance

Further, we checked on CGST tax act and according to it any business/entity has to register themselves under Goods and Services Tax, if their aggregate turnover in a financial year exceeds Rs 40 lakhs (in all normal category states, except Telangana) and Rs 20 lakhs (in special category states, except J&K and Assam).

Conclusion:

There is no separate tax for any religion so the claim of Himanshu Malhotra is fake.