A claim is going viral on social media that from April 1, a 1.1% surcharge will be levied on transactions of more than 2000 rupees through UPI payment platforms such as Google Pay, PhonePe, Paytm, etc. Ritu #सत्यसाधक, a Twitter user, posted a tweet claiming that a surcharge of 1.1% will be charged on transactions over 2000 rupees on UPI (translated from Hindi) and added, “Follow the basics…cash/debit card/credit card, for the protection of your freedom…Agenda 2030 is serious and true, resist it…”. This tweet was shared widely with over 1.3 lakh followers.

Narender Balyan, a legislator from the Aam Aadmi Party, also tweeted about it, stating, “From April 1, a tax of 1.1% will be levied on payments through UPI platforms such as Google Pay, PhonePe, Paytm. So, if you buy ration worth 3000 rupees, you will have to pay an additional 32 rupees. Remember how these thugs were marching on UPI, why this new loot now? People will leave online payments and go back to cash to avoid looting.”

Several other social media users and media outlets also made similar claims.

Is that connection?? pic.twitter.com/EhND7zU4B9

— Dis'Qualified User ︎ ︎ ︎ ︎ 3.1.0 (@RoflElon) March 29, 2023

Fact Check

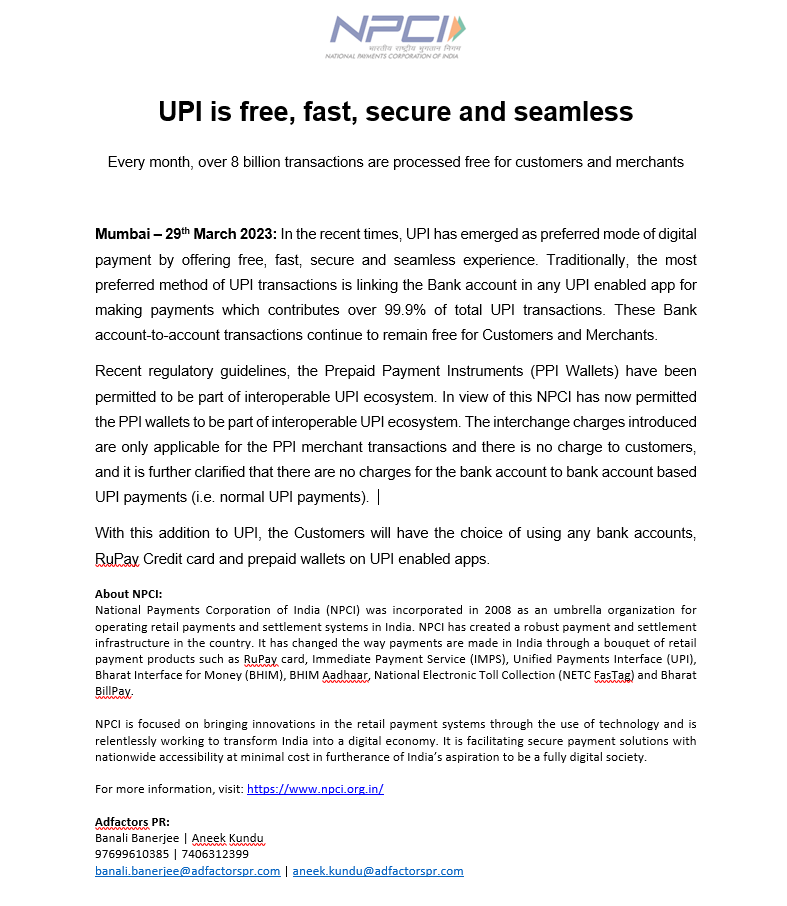

To fact-check this viral claim, the DFRAC team searched for relevant keywords on Google and found a tweet from the National Payment Corporation of India (NPCI) on March 29, 2023, which operates the Unified Payment Interface (UPI). The tweet stated, “NPCI press release: UPI is free, fast, secure and uninterrupted. Every month, over 8 billion transactions are processed free for customers and businesses using bank accounts.”

NPCI has denied the rumors about charges being levied on UPI transactions in a press release. They stated that customers will not have to pay any charges when making transactions through UPI from one bank account to another. NPCI clarified that 99.9% of UPI transactions in the country are processed through bank accounts.

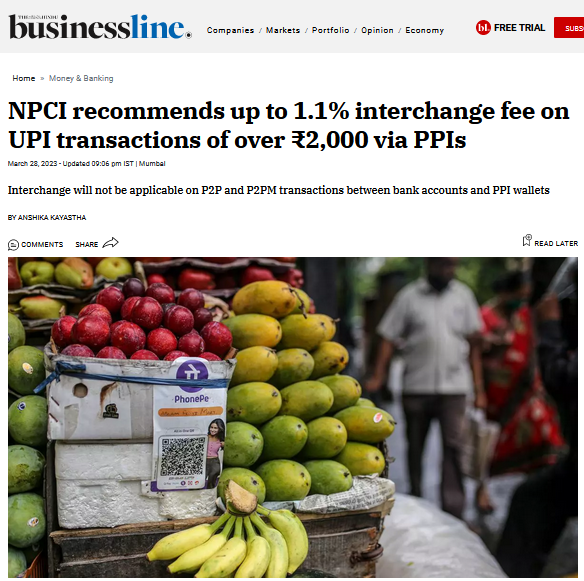

According to NPCI’s press release, there will be no charge for customers or banks when making UPI payments. Similarly, no charge will be levied when making UPI transactions from one bank account to another. NPCI has also granted permission to prepaid payment instruments (PPI wallets) to be a part of the interoperable UPI ecosystem. NPCI has stated that intercharge charges will be applicable only for PPI merchant transactions, and customers will not have to pay any charges for this.

Conclusion

Conclusion: After being debunked by the NPCI, it is clear that the claim made by media and social media users that “1.1% tax must be paid on UPI payments” is false.