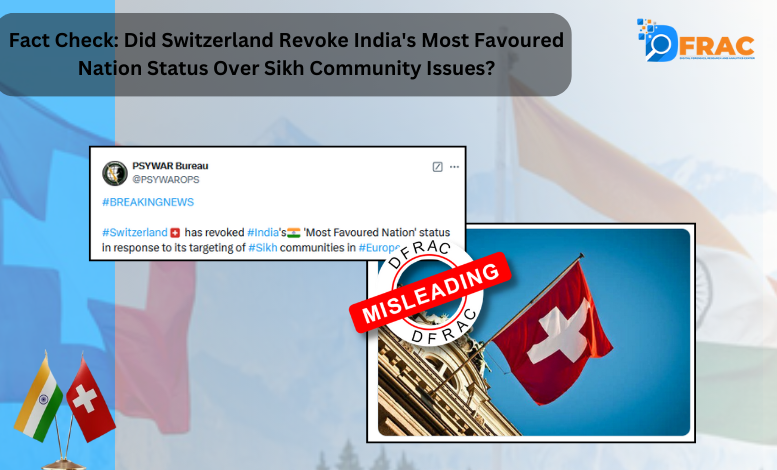

On social media, news from India and Switzerland has gone viral. Users shared the news with the claim, “Switzerland has revoked India’s ‘Most Favoured Nation’ status in response to its targeting of Sikh communities in Europe.”

Fact Check

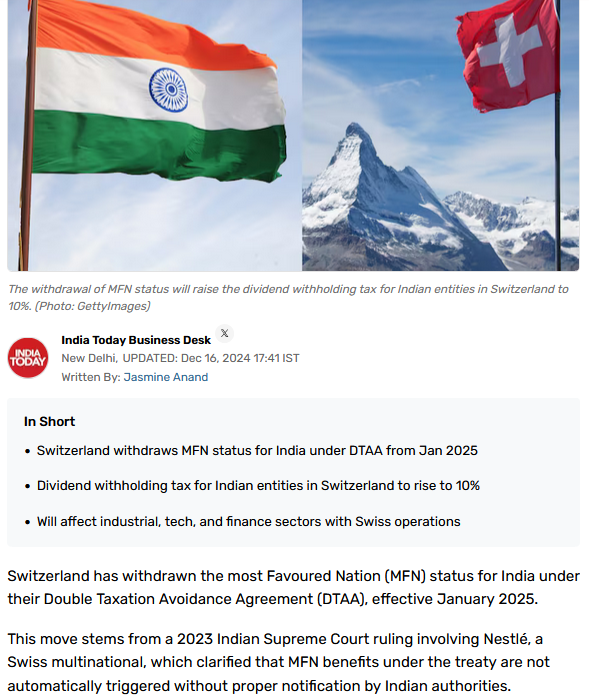

During the investigation, DFRAC found the claim to be false. We discovered multiple media reports on the issue. According to a Hindustan Times report published on December 14, 2024, “Dividends of Indian entities will be taxed at 10% in Switzerland from January 1, as the European nation has suspended the most favoured nation (MFN) clause in its Double Taxation Avoidance Agreement (DTAA) with India.”

Additionally, a Times of India report from December 16, 2024, states, “Switzerland has withdrawn the Most Favoured Nation (MFN) status for India under their Double Taxation Avoidance Agreement (DTAA), effective January 2025. This move stems from a 2023 Indian Supreme Court ruling involving Nestlé, a Swiss multinational, which clarified that MFN benefits under the treaty are not automatically triggered without proper notification by Indian authorities.”

Conclusion

It is clear from DFRAC’s fact check that the claim circulating on social media about Switzerland revoking India’s ‘Most Favoured Nation’ status in response to its targeting of Sikh communities in Europe is false. The actual reason for the withdrawal of the MFN status is related to a legal matter concerning the Double Taxation Avoidance Agreement (DTAA) between India and Switzerland, not any political or social issue involving Sikh communities.